🚀 Automate your workflows with AI instruments! Uncover GetResponse AI-powered automation and save time!

The lifetime of a finance skilled can generally really feel like “Groundhog Day”: on daily basis, week, and month-end, you are performing the identical repetitive duties that make you need to smash a radio each time you hear a Sonny & Cher tune. Invoice Murray wanted to develop selflessness and empathy to flee his hellscape; your path to salvation is far simpler.

Finance automation software program is your ticket to freedom: know-how that may enable you to streamline reconciliations, speed up monetary shut, automate accounts payable, and expedite expense administration. I’ve researched, examined, and vetted the perfect finance automation software program available on the market to convey you the highest instruments for each enterprise stage.

Are you prepared for an early, automated spring?

The 9 finest finance automation instruments

-

Zapier for AI orchestration

-

QuickBooks for product-based companies

-

NetSuite for enterprise useful resource planning

-

BILL for small enterprise accounts payable/receivable

-

Stampli for accounts payable

-

Tipalti for international vendor collaboration

-

Ramp for spend administration

-

PayPal for transaction administration

-

Wave for budget-friendly invoicing

What makes the perfect finance automation software program?

How we consider and take a look at apps

Our greatest apps roundups are written by people who’ve spent a lot of their careers utilizing, testing, and writing about software program. Except explicitly said, we spend dozens of hours researching and testing apps, utilizing every app because it’s meant for use and evaluating it towards the standards we set for the class. We’re by no means paid for placement in our articles from any app or for hyperlinks to any web site—we worth the belief readers put in us to supply genuine evaluations of the classes and apps we evaluation. For extra particulars on our course of, learn the complete rundown of how we choose apps to characteristic on the Zapier weblog.

Finance automation is a broad umbrella reasonably than a definite product, which may make it troublesome to discover a answer that matches your actual wants. There’s invoicing software program, accounts payable platforms, small enterprise accounting instruments, enterprise automation software program, and several other different subsets that span the monetary ecosystem.

In an effort for equal illustration, I made certain my checklist included the best hits throughout the trade. So, when you’re a small enterprise that wants assist with accounts payable, I’ve that. In case you’re an enterprise-level group that desires to streamline vendor administration, I’ve that too. Consider this write-up as a digital Baskin-Robbins, the place yow will discover the right taste in your finance staff.

To additional refine my checklist, I evaluated every software program possibility with the next in thoughts:

-

AI and automation: Most software program immediately affords some type of AI and automation, however capabilities range wildly. Some merchandise provide generic chatbots or frivolous options that really feel tacked on simply to satisfy a quota and maintain the board of administrators completely happy. Others characteristic actually revolutionary AI and automation capabilities that make an enormous impression on your small business. When evaluating merchandise, I prioritized instruments the place AI drives ROI.

-

Integrations: Many companies immediately are swimming in software program—they could use an app for staff communications, one for vendor collaboration, one for CRM, one for monetary planning, and all the pieces in between. I ensured each possibility on this checklist has substantial integration capabilities—natively or by way of Zapier—so you possibly can join your total tech stack underneath one automated roof.

-

Knowledge safety: Whereas all enterprise knowledge is delicate, monetary data requires severe safety. The apps I selected wanted to display sturdy safety measures, reminiscent of complete audit trails and role-based entry, to assist maintain your books audit-ready and safe. However remember the fact that not all of those apps have the identical degree of bank-grade safety, and you need to solely cross delicate knowledge by way of platforms that meet your particular compliance requirements.

The perfect monetary automation software program at a look

|

Finest for |

Standout characteristic |

Pricing |

|

|---|---|---|---|

|

AI orchestration |

AI copilot to construct workflows with pure language |

Free plan obtainable; from $19.99/month |

|

|

Product-based companies |

Superior Pricing that automates pricing fashions |

From $2,210/yr |

|

|

Enterprise useful resource planning |

AI Advisor that integrates AI throughout the app |

Contact for pricing |

|

|

Small enterprise accounts payable/receivable |

Auto-send invoicing |

From $49/consumer/month |

|

|

Accounts payable |

In-app staff and vendor communication |

Contact for pricing |

|

|

World vendor collaboration |

Automated vendor tax verification |

From $99/month |

|

|

Spend administration |

AI-powered expense approvals and evaluation |

Free plan obtainable; from $15/consumer/month |

|

|

Transaction administration |

Buyer/vendor-facing AI agent |

Fee-based pricing |

|

|

Price range-friendly invoicing |

Automated Transaction Categorization to kind bills |

Free plan obtainable; from $19/month |

Finest finance automation software program for AI orchestration

Zapier (Net)

Zapier execs:

-

Complete workflow builder

-

8,000+ apps and integrations, together with QuickBooks, NetSuite, PayPal, and Wave

-

Constructed-in instruments for AI brokers, AI chatbots, databases, and varieties

Zapier cons:

Zapier is an AI orchestration platform, so it is a little bit completely different from the opposite instruments on this checklist. You’ll be able to’t create invoices, invoice purchasers, or steadiness your books straight on the platform, however you possibly can facilitate all these actions. It is the automation layer that connects all of your instruments, placing an finish to your repetitive duties.

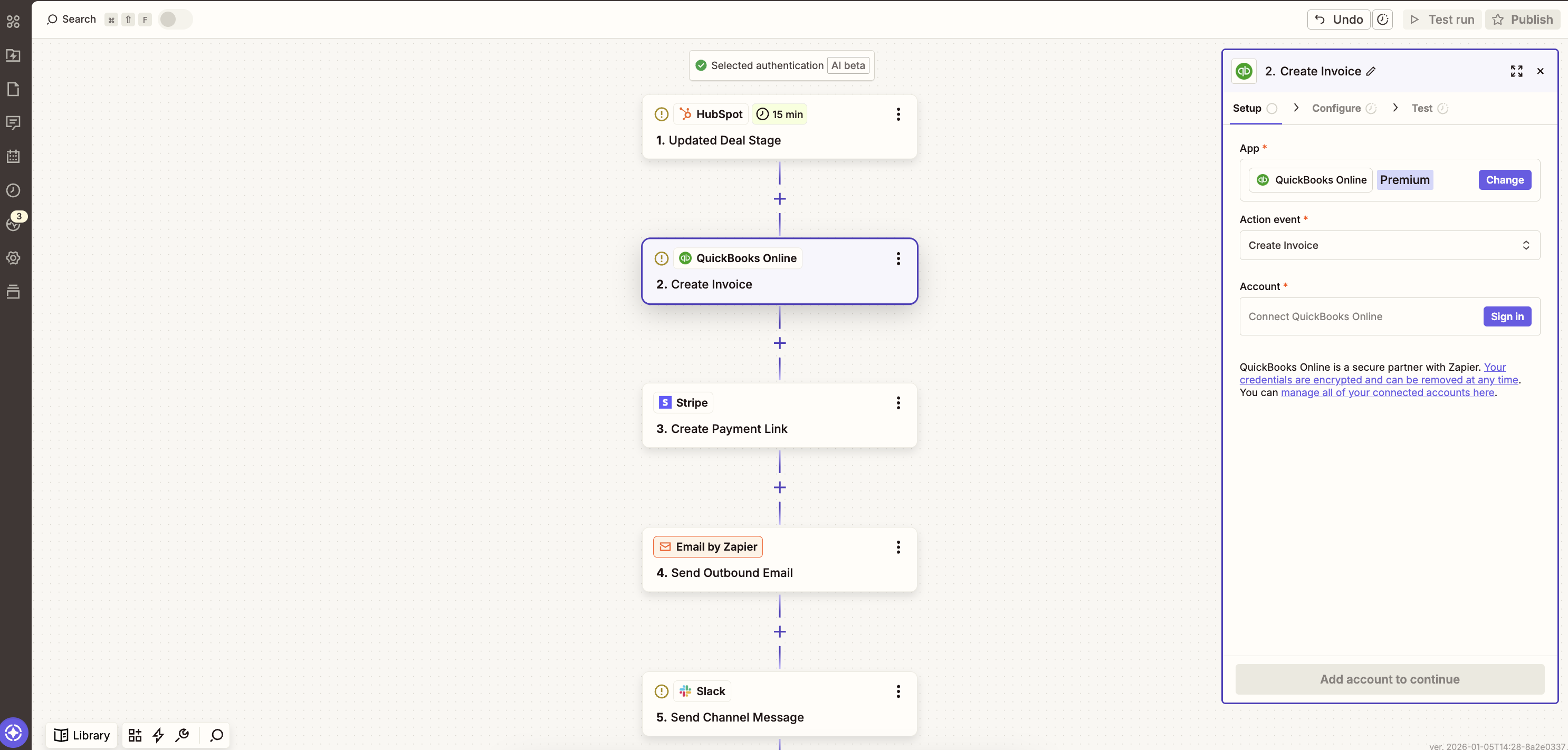

All of it begins with the workflow builder, your hub for linking 8,000+ apps and creating AI-powered sequences. You’ll be able to construct a no-code monetary workflow from scratch—no builders required—or use Zapier Copilot, an clever assistant that may mechanically construct what you want primarily based on plain-English directions.

For instance, when a member of your staff marks a deal as “closed” in HubSpot, your Zapier workflow may mechanically generate an bill in QuickBooks, create a Stripe cost hyperlink, electronic mail that data to your new consumer, and ship a Slack message to inform your finance staff. You might add human-in-the-loop checkpoints alongside the best way, or belief the system to work its magic (which it does, time after time).

Want inspiration? Discover Zapier’s workflow templates, which you should use straight or tweak to suit your wants. You may also try our full guides on utilizing Zapier to automate invoicing or accounting.

Because you’re on the Zapier weblog, it might be exhausting to take our phrase for it—so do not. Hearken to companies which have discovered success with Zapier.

Zapier pricing: Free plan obtainable, Skilled ($19.99/month, billed yearly), Crew ($69/month, billed yearly), Enterprise (contact Zapier)

Finest finance automation software program for product-based companies

QuickBooks Enterprise (Net, iOS, Android)

QuickBooks Enterprise execs:

-

200+ built-in reporting templates

-

Superior Pricing automates advanced pricing guidelines (relying on plan)

-

As much as 40 completely different customers for big groups (relying on plan)

QuickBooks Enterprise cons:

QuickBooks Enterprise is sort of a Toyota Corolla; it is not flashy, however it’s dependable, sensible, and constructed to suit your wants for a lengthy time. It is the upgraded model of vanilla QuickBooks—good for companies which have outgrown the bottom performance and wish a little bit extra punch for his or her monetary division.

You’ll be able to nonetheless do numerous the identical issues in Enterprise which have made QuickBooks so in style. Constructed-in payroll permits you to handle payroll and accounting in a single place. Built-in funds enable you to receives a commission sooner and maintain transactions tied to invoices. Plus, 200 completely different integrations permit you to sync methods like your CRM, stock administration, and different factors in your eCommerce pipeline.

The place Enterprise actually spreads its wings is with the added automation options you will not discover within the base product. It comes with 200+ built-in stories—together with standouts like merchandise profitability and bill profitability—so you possibly can spend much less time gathering knowledge and extra time analyzing it.

In case you’re a enterprise with bodily stock, Superior Stock will help automate your logistics. With just some clicks, you possibly can handle distributors, monitor freight and duties, calculate landed prices, and keep away from questions like, “Wait, the place is that this cargo going once more?”

One other key characteristic of QuickBooks Enterprise is the Superior Pricing. When you’ve got a number of SKUs, you could have a number of pricing fashions—you possibly can provide quantity reductions, apply markdowns, use gross sales and promotions, and even have completely different pricing relying on who’s ordering (e.g., high-value prospects). You might want to set the principles, however when you do, QuickBooks mechanically applies the suitable worth primarily based on these parameters.

All in all, QuickBooks Enterprise is a dependable product that is finest suited to companies with bodily stock. It does not present a powerful quantity of integrations, however you possibly can overcome that by connecting QuickBooks to Zapier—attempt syncing your cost processor, CRM, and Slack channels to maintain your staff on the identical monetary web page. Be taught extra about how one can automate QuickBooks, or get began with a pre-made template.

QuickBooks Enterprise pricing: Gold ($2,210/yr), Platinum ($2,717/yr), Diamond ($5,363/yr)

Finest finance automation software program for enterprise useful resource planning

NetSuite (Net, iOS, Android)

NetSuite execs:

-

Predictive evaluation and forecasting

-

Complete AI options

-

Enterprise-grade safety

NetSuite cons:

-

Steep studying curve

-

Non-transparent pricing

NetSuite is a true-blue enterprise useful resource planning (ERP) platform. So, when you’re a small enterprise proprietor who merely desires assist processing invoices and managing a couple of accounts, NetSuite will make you marvel when you’ve simply been jettisoned to Mars. However when you’re a bigger operation with the must match, NetSuite will make you are feeling proper at house.

The software program has a lot to supply that it is exhausting to summarize it in only some paragraphs. Beginning with the accounts payable (AP) options, you possibly can entry a devoted, customizable dashboard that permits you to monitor buy orders (POs), invoices, and scheduled funds from a real-time interface. No extra scanning by way of electronic mail chains or chat messages; it is all proper the place you possibly can see it. With Clever Cost Automation, you possibly can arrange a hands-free system to pay and schedule payments, observe funds, and automate GL entries. In different phrases, you by no means must ask your self when you’ve paid your invoices but—you know you may have.

As I dove deeper into the NetSuite AI rabbit gap, I grew to become extra impressed. The platform options an AI Advisor that may help your staff throughout the complete product suite. You should use predictive planning to investigate massive datasets and mechanically highlight developments, apply predictive forecasting to enhance monetary planning accuracy, and even construct an AI agent and customise the format, tone, and artistic responses by way of the NetSuite Immediate Studio.

The NetSuite Connector permits you to sync all of your different instruments. It prominently shows compatibility with eCommerce instruments like Shopify, market platforms like eBay, and CRMs like Salesforce—permitting you to hyperlink your gross sales funnel from high to backside.

On the info safety entrance, NetSuite affords enterprise-grade safety features, reminiscent of sturdy encryption, role-based entry controls, and password insurance policies. The software program can be audited to SOC 1 Sort II and SOC 2 Sort II and is licensed for ISO 27001:2013 and PCI DSS, amongst others.

In case you resolve to go together with NetSuite, anticipate a studying curve; it is a huge system that would take you weeks to totally discover. However it’s a stable possibility for bigger groups—and one you possibly can combine with Zapier to boost your advertising and marketing efforts, streamline accounting, automate staff collaboration, and construct higher workflows. Be taught extra about how one can automate NetSuite, or get began with a pre-made template.

NetSuite pricing: Contact for pricing.

Finest finance automation software program for small enterprise accounts payable/receivable

BILL (Net, iOS, Android)

BILL execs:

BILL cons:

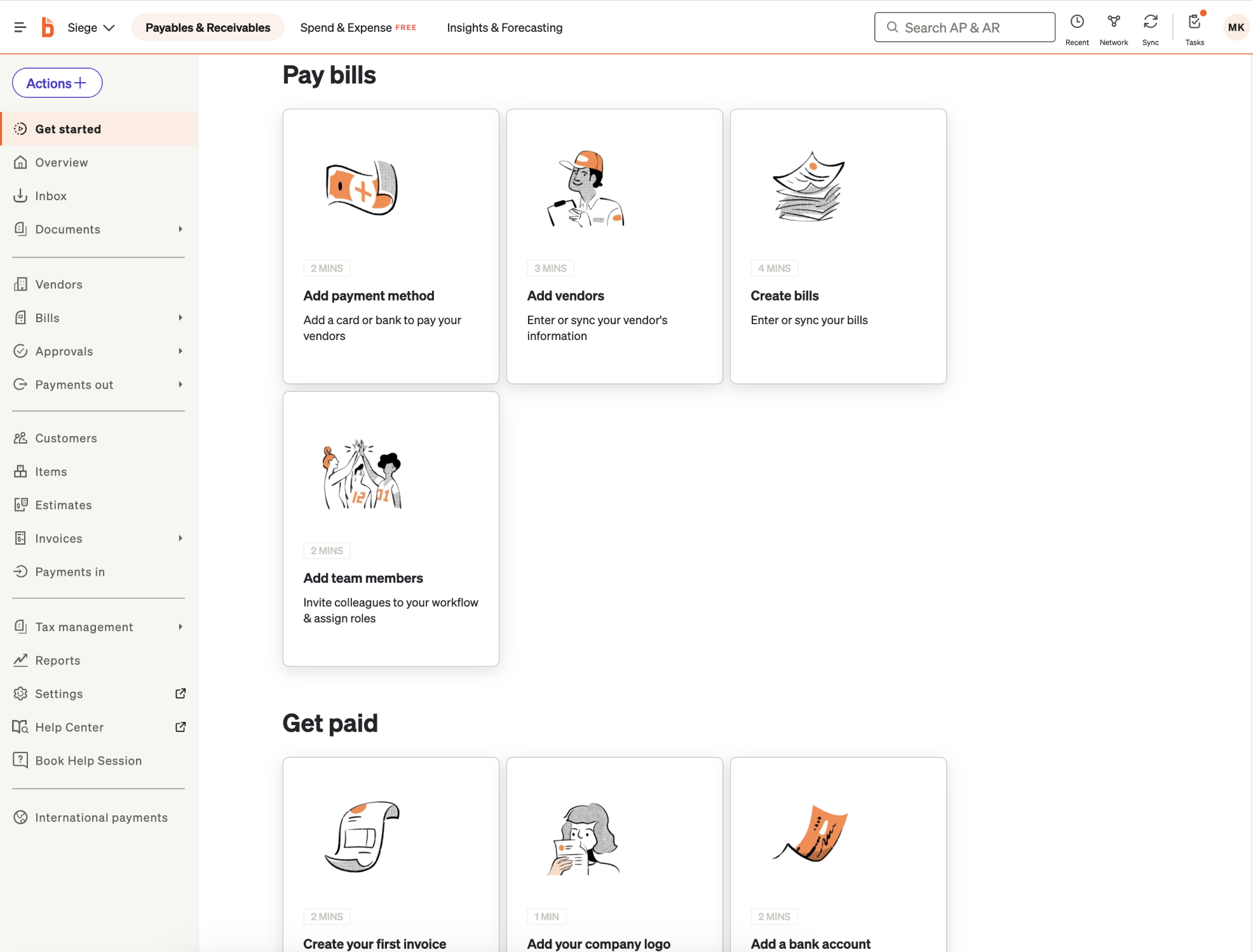

Let me simply lay all of it on the desk: BILL is pleasant. It is an automatic finance software that excels in accounts payable/accounts receivable (AR) with an especially easy-to-use interface as well. As I used to be testing, it had me chanting “BILL!” like I used to be watching the intro to “Invoice Nye the Science Man.”

Beginning with AP, BILL can automate your approval course of by monitoring steps, sending reminders, and monitoring who permitted what, so your system retains working with out you having to babysit it. The corporate additionally advertises that the platform will pay as much as 2,000 payments at one time—a determine I discovered equal components terrifying and awe-inspiring.

As somebody with a burning hatred for repetitive invoices, what I discovered most spectacular is the automated invoicing options. BILL can automate two- and three-way matching, examine invoices towards POs, and seize key bill fields with 95% accuracy. In different phrases, the invoices you’ve got crammed out considering, “Why cannot this be automated?” lastly might be.

The AR options are a bit much less flashy however equally as helpful. BILL permits you to create and customise invoices, schedule and auto-send them, observe them, and nudge your prospects when funds are overdue. The “nudge” is a well mannered electronic mail follow-up, which might be higher than my strategy, which is to ship a message with the topic line, “Why have not you paid this but?”

Automation options come into play by way of integration capabilities with the remainder of your tech stack. BILL can sync with the hits like QuickBooks, NetSuite, Workday, ADP, and plenty of different in style instruments. Whilst you cannot precisely construct your personal workflows, merely syncing these methods can streamline your workday.

General, BILL is an easy-to-use finance automation platform that makes small-business AP/AR really feel much less chore-like. It even contains multi-layered safety and AICPA SOC 2 compliance to maintain your knowledge secure. So, when you’re searching for a no-nonsense system to streamline your staff, BILL is value contemplating.

BILL pricing: Necessities ($49/consumer/month), Crew ($65/consumer/month), Company ($89/consumer/month), Enterprise (contact for pricing)

Finest finance automation software program for accounts payable

Stampli (Net, iOS, Android)

Stampli execs:

Stampli cons:

Stampli is a procure-to-pay platform that makes a speciality of AP, funds, and vendor administration. Your entire ecosystem is built-in with Billy, Stampli’s “AI worker” that may information you with nearly any course of.

Considered one of Stampli’s standout options is that each one communication occurs totally throughout the app. With out a standardized platform, AP groups typically juggle a number of conversations spanning textual content messages, telephone calls, emails, and provider pigeons, resulting in missed data and inaccurate invoices. Stampli retains all communication linked with the bill itself, so nobody is confused or neglected of the loop come cost time.

The invoicing course of is simply as straightforward, because of our good friend Billy. That little AI rascal can mechanically extract key bill knowledge and put together paperwork in your AP groups, lowering handbook knowledge entry and errors. In case you’d reasonably have a set of human eyes in your operations, Stampli affords drag-and-drop importing to assist your staff populate invoices sooner. Different notable AI options embody two- and three-way line-level PO matching, managing worker data requests, and validating compliance.

Integration-wise, Stampli favors ERPs, providing entry to 70+ platforms, together with Sage, Microsoft, and SAP. Whereas good to have, the integrations appear fairly skinny in comparison with a number of the different choices on my checklist (and Stampli does not join with Zapier, so you possibly can’t enhance that quantity, both). The safety features, then again, are fairly sturdy: SSO, audit trails, and software program improvement lifecycle (SDLC) safety spherical out a stable platform.

In case you’re out there for a complete AP platform, give Stampli a attempt.

Stampli pricing: Contact for pricing.

Finest finance automation software program for international vendor collaboration

Tipalti (Net, iOS, Android)

Tipalti execs:

-

Helps international purchasers throughout nearly each nation and 120 currencies

-

Self-onboarding vendor course of

-

KPMG-certified tax compliance

Tipalti cons:

Do you may have a freelancer in France? A provider in Sweden? A hyper-specific vendor in Vietnam? Tipalti will help you navigate completely different currencies, tax rules, W-9s and W-8s, and financial institution charges as simply as checking off your to-do checklist.

I rapidly realized one of many major issues that makes Tipalti so particular is its capacity to cease cost issues earlier than they even begin. When a Tipalti consumer takes on a brand new vendor, that vendor wants to finish a self-onboarding course of. That course of requires the seller to submit their tax paperwork (from no matter nation they’re in), and Tipalti mechanically verifies the knowledge. So, earlier than that vendor may even suppose about collaborating with you in items and companies, they will need to have their tax data sorted and verified. You hear that noise? It is the sound of your audit-obsessed accounting staff respiratory out an enormous sigh of aid.

When it is time to submit funds, Tipalti’s mass cost characteristic automates the complete workflow. You’ll be able to hyperlink your tech stack by way of APIs that help key software program like ERPs, accounting platforms, HRIS, and cost processors. As soon as your system is ready up, Tipalti Pi (the AI engine) handles automated trade fee administration, real-time reporting, and built-in tax compliance, specializing in W-9, W-8, VAT, SIN, BN, and DAC7 reporting.

General, I discovered Tipalti’s finance automation options to be extraordinarily helpful, and I solely lined the tip of the iceberg. I would not suggest it to small and even mid-sized companies that solely work with home distributors. However in case you have a large-scale group that offers with worldwide distributors, you possibly can’t do a lot better than Tipalti.

Tipalti pricing: Choose ($99/month), Superior ($199/month), Elevate (customized pricing)

Finest finance automation software program for spend administration

Ramp (Net, iOS, Android)

Ramp execs:

Ramp cons:

-

Requires a minimal money steadiness of $25,000

-

Restricted worldwide help in comparison with different merchandise on this checklist

Ramp encapsulates numerous monetary areas, together with company playing cards, accounts payable, expense stories, and buying. Nevertheless, the platform actually excels in expense administration; it is type of like your dad scrutinizing your financial institution statements in school, asking why you are spending a lot cash at Goal or frequently paying $15 for a hamburger when McDonald’s is true down the street out of your condominium.

The Ramp spend administration system is fairly ingenious. Earlier than you situation a single company card, your finance staff can set spending limits, block retailers, and limit classes. When an worker makes a purchase order, Ramp captures all related data, makes edits (if wanted), and sends the receipt to the suitable expense staff by way of SMS, Slack, or Microsoft Groups. Ramp also can present automated ideas to your staff, to allow them to both approve purchases in a single click on or analyze the receipt for discrepancies.

However past the world of easy expense administration lies a whole AI-powered ecosystem. Ramp’s AI brokers are like a round the clock finance staff that may scrutinize each cent that goes out and in of your accounts. These brokers can mechanically deal with low-risk approvals and flag any high-risk entries that want human evaluation. They’ll analyze your staff’s spending throughout designated classes and flag areas the place you are spending an excessive amount of. They’ll even catch fraud, validate invoices, and reply questions over textual content—type of like your dad again within the day.

The platform integrates with 160+ instruments, together with NetSuite, QuickBooks, Workday, and Xero. It additionally affords safety features like SSO and knowledge encryption. You’ll be able to even arrange a digital bank card for a single vendor, in order that card solely works for them, thereby limiting potential fraud or asset threat.

Like most software program on this checklist, Ramp affords a bunch of monetary capabilities. That stated, if you wish to hone in in your spend administration, it is exhausting to discover a stronger possibility.

Ramp pricing: Free plan obtainable, Plus ($15/consumer/month), Enterprise (Customized)

Finest finance automation software program for transaction administration

PayPal (Net, iOS, Android)

PayPal execs:

-

World acceptance throughout 200+ markets and 25+ currencies

-

AI agent transaction administration

-

Trusted model for vendor or buyer ease-of-mind

PayPal cons:

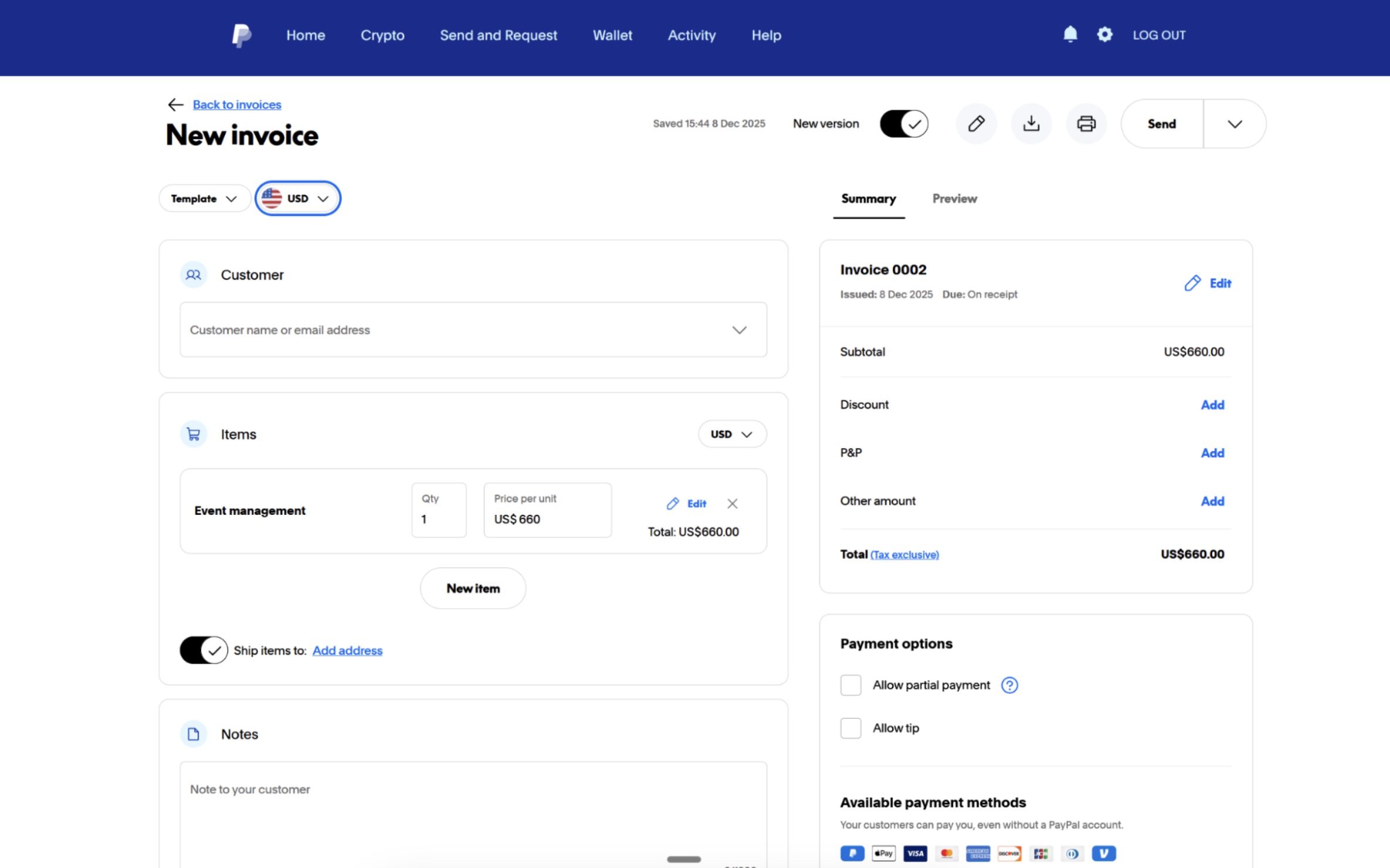

PayPal has a few distinctive attributes. First, it has highly effective model recognition; that massive “P” emblem can put a consumer comfortable, which is particularly useful when you’re a small enterprise sending or receiving cost from somebody new. Second, it is greater than a private pockets (which is why it grew to become well-known, you possibly can argue)—it can be a full-scale transaction engine.

PayPal organizes its choices into three tiers: solopreneur, small enterprise, and enterprise. Solopreneurs and small companies can use invoicing/cost administration, vendor protections, checkout integrations, and versatile mortgage funding. The enterprise options get a bit juicier, with expanded options like international cost administration and automatic cost orchestration.

Now, when you had requested me a couple of months in the past if I assumed PayPal ought to be on this checklist, I might in all probability say no. However resulting from my trade connections and a well-timed press launch, I’ve uncovered new options which will already be dwell by the point you are studying this.

PayPal is rolling out agent-driven commerce experiences in 2026. The standout characteristic for me is an AI agent that you may implement in your checkout pages throughout apps. So, if one in all your prospects or distributors asks a query in your web site, app, or different supported channel, an AI agent can step in and assist them.

Internally, PayPal can be introducing upgraded buy, vendor, and fraud safety options that may streamline identification verifications and cost disputes.

You’ll be able to combine PayPal with accounting methods like QuickBooks, marketplaces like Etsy, and eCommerce platforms like Shopify, to call a couple of. For much more capabilities, join PayPal with Zapier to construct multi-step workflows throughout your tech stack—like sharing new gross sales in your Slack channel or mechanically including new contacts to your CRM after PayPal transactions. Be taught extra about how one can automate PayPal, or get began with a pre-made template.

PayPal pricing: Fee-based pricing; charges begin at $0.49, plus 1.5% to three.49% per transaction

Finest finance automation software program for budget-friendly invoicing

Wave (Net, iOS, Android)

Wave execs:

Wave cons:

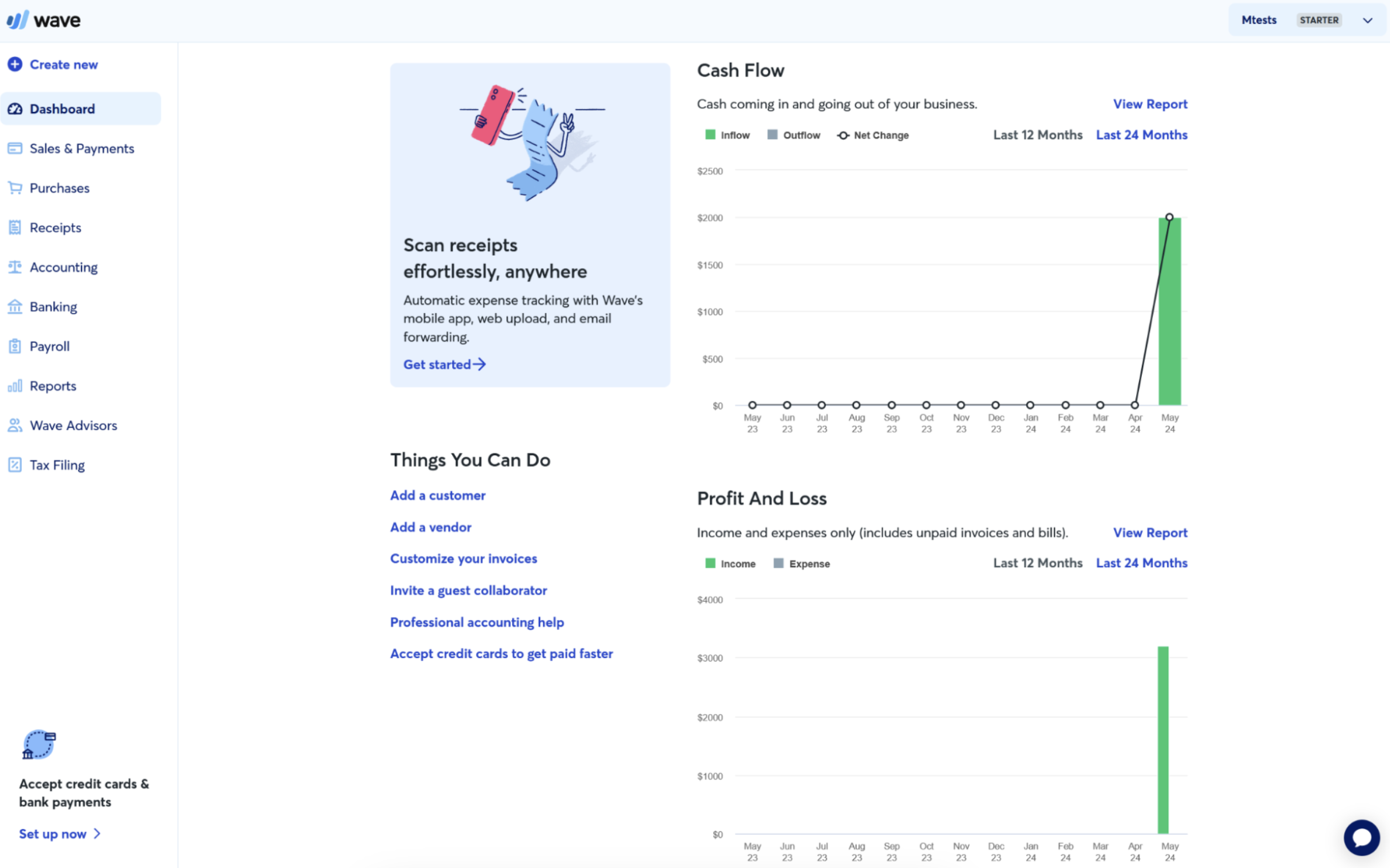

Wave is principally my childhood finest good friend. I used it for months early in my profession and was immediately blown away by its ease of use and impeccable consumer expertise. Coming again to all of it these years later, it is good to see that nothing has modified; the truth is, it is gotten higher.

The product is a champion for small companies. It equips solopreneurs and sparse groups with the instruments that make them look larger than their steadiness sheet.

The invoicing and cost system was Wave’s bread and butter once I first used the software program, and it is nonetheless sturdy. You should use it to rapidly create invoices, construct templates for recurring funds, and join all the pieces to your accounting performance. Wave additionally affords different key capabilities associated to payroll, expense administration, and cost processing.

Like PayPal, Wave wasn’t initially on my checklist. Although I knew the product was helpful, I wasn’t bought on the AI and automation capabilities till I reacquainted myself with the platform. Nothing right here will blow your AI socks off, however there are easy issues that may prevent money and time.

Wave permits you to arrange recurring invoices for long-term purchasers and create computerized cost reminders for overdue invoices. With the Automated Transaction Categorization characteristic, you possibly can even import and categorize financial institution transactions mechanically—say goodbye to getting into knowledge manually.

The information safety is satisfactory for such a easy software. Wave is Degree 1 PCI-DSS licensed, affords 256-bit encryption, and boasts about its safe knowledge storage procedures.

One space the place Wave can really feel limiting, nonetheless, is in its native integrations—there aren’t many helpful choices. That stated, you possibly can mitigate this by connecting Wave to Zapier, so you may get new bill notifications on Slack, mechanically switch knowledge to Google Sheets, or report gross sales straight in Wave. Be taught extra about how one can automate Wave, or begin with a template.

Wave pricing: Free plan obtainable, Professional Plan ($19/month); on-line funds charged at a proportion plus a set fee

Different finance automation instruments

Whereas I strived to supply a powerful, well-rounded checklist, a couple of different merchandise deserve a shout-out. They’re nice platforms that simply did not discover a spot on my checklist for one purpose or one other.

-

BlackLine: A cloud-based software designed to assist companies automate their monetary closes. It is significantly helpful for bigger groups trying to centralize knowledge.

-

Solvexia: A no-code system that assists finance groups in managing knowledge and automating tax and compliance processes. It is useful for groups that need to leverage AI and automation while not having a big dev staff.

-

Xero: A small enterprise accounting software that may deal with invoicing, bills, and financial institution reconciliations. It is nice for freelancers or small companies, and it affords over 1,000 integrations.

-

Brex: A monetary platform that may automate expense administration, invoice funds, and even enterprise journey preparations. It is an all-in-one spend administration system that is excellent for established groups.

Automate your finance workflows with Zapier

Deciding on a finance automation software can really feel such as you’re counting on a groundhog. Are you prepared to leap into the suitable product and expertise an early spring? Or will your inaction trigger six extra weeks of non-automated winter?

Zapier is an AI-orchestration powerhouse that simplifies your finance processes, syncs with 8,000+ apps, and eliminates knowledge silos throughout your group—all with out the necessity for builders.

Associated studying:

🔥 Supercharge your small business productiveness → attempt CustomGPT for personalised AI brokers immediately!